3232 McKinney Ave.

Suite 500

Dallas, TX 75204

Error: Contact form not found.

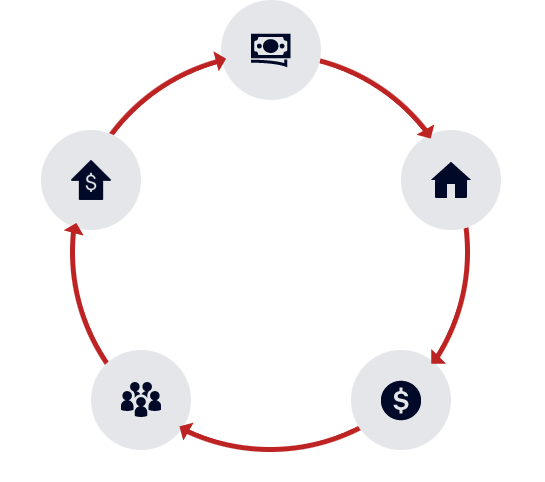

AmeriCan Multifamily Alliance Group adheres to a carefully constructed investment model centered on these guiding objectives:

AmeriCan acquires under-performing properties at a discount and with large appreciation potential. Properties must qualify for a quick refinance. This typically requires narrowing down 100+ prospective deals to one shiny diamond.

AmeriCan only purchases properties that have great potential for increased value. These properties must have flaws that AmeriCan can fix and must possess multiple “value add” scenarios that can be monetized through our Value-Add Business Model and Impact Plan.

AmeriCan is leading a movement to transform apartment complexes into thriving, healthy communities by making positive social and environmental impacts as important as financial returns. AmeriCan consistently outperforms the market because its secret sauce of social and environmental responsibility causes “stickiness” within the communities. This translates to high tenant retention, elevated occupancy rates and increased rental fees, which help drive increased property values and returns.

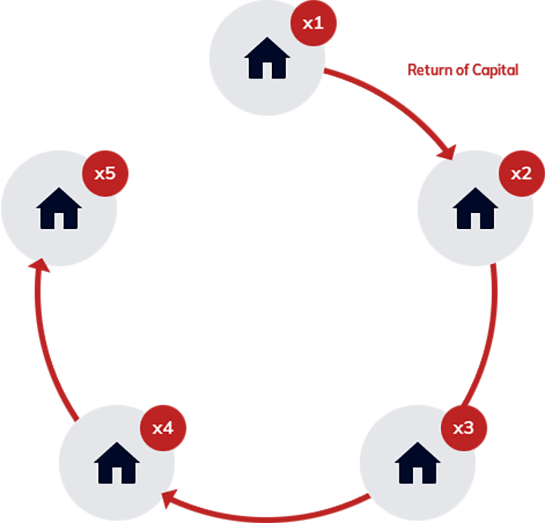

A refinance event is mandatory. AmeriCan recognizes that refinancing and paying back investors a significant part of their original investment is the ideal way to accelerate wealth and will work diligently to ensure it happens. The company has a 100% success rate in this regard.

AmeriCan realizes the peace of mind and security that goes along with having an investor’s initial capital returned, while maintaining ownership for long-term cash flow and appreciation. relates to qualifying as an accredited investor.

Leverage is an important advantage in real estate investing, and AmeriCan uses your same original capital again and again. Investors’ initial investment ultimately allows them to participate in ownership of multiple multifamily properties.

Please fill out the form below.

Error: Contact form not found.